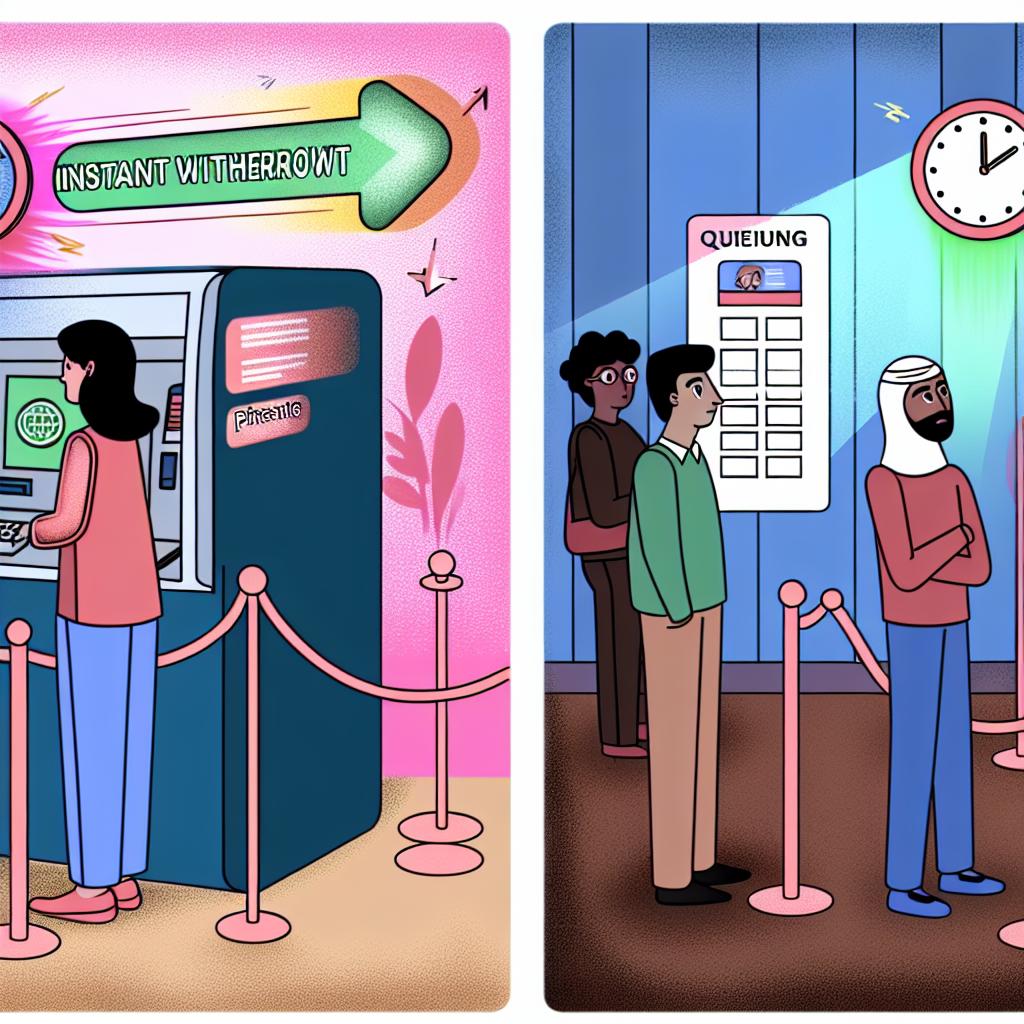

Understanding Instant Withdrawal and Standard Processing Times

In the realm of financial transactions, the processes of fund withdrawal vary significantly in terms of speed and cost, particularly when comparing instant withdrawal with standard processing times. Understanding these differences not only enhances one’s ability to make well-informed financial decisions but also aids in strategic financial planning.

Instant Withdrawal

The term instant withdrawal describes the rapid transfer of funds from one account to another. This feature is prized for its swiftness, allowing users to access their money without delay. It is particularly beneficial in scenarios where immediate financial liquidity is necessary, such as unexpected expenses or time-sensitive business needs.

Generally, instant withdrawal is available on various financial platforms for a fee. The added charge is due to the prioritization of your transaction over others, ensuring that the funds reach the destination quickly. This kind of service is predominantly utilized in sectors like online gaming, e-commerce, and among certain modern banking solutions. Despite its advantages, instant withdrawal might not be accessible with all banks or service providers for every type of account or transaction.

Considerations for Instant Withdrawal

While the allure of quick access to funds can be strong, instant withdrawal often incurs additional fees. These can differ greatly, depending on the service provider and the magnitude of the transaction. Therefore, it is prudent to weigh these costs against the urgency of the need for funds when deciding on employing instant withdrawal.

Additionally, the availability of instant withdrawal is subject to certain conditions. These contingencies may hinge on the type of account held, the policies of the bank, or the particular requirements of the financial platform in use. For instance, some services may only offer instant withdrawal for transactions that exceed a certain minimum amount.

Standard Processing Times

Standard processing times refer to the conventional method of handling withdrawals, where transactions follow the bank or financial institution’s regular schedule. This timeframe might span several business days, particularly if the transaction involves different banks or international transfers, owing to the requisite verifications and clearing processes.

Nevertheless, standard processing times are typically free from additional charges, making them a cost-effective option for transactions that are not urgent. Users often prefer this method when timing is less critical, or they seek to avoid the expenses related to instant withdrawals.

Factors Affecting Standard Processing Times

There are several elements that can influence standard processing times:

- Banking Hours: Transactions initiated outside the operating hours might encounter delays.

- Holidays and Weekends: Transactions processed on non-business days can experience extended delays.

- International Transactions: The need for currency conversion and adherence to cross-border regulations can lengthen the processing timeframe.

Banks and financial institutions have established these standard practices to ensure compliance with various regulatory and security protocols. Understanding these factors can help in effectively planning financial transactions.

Alternative Financial Solutions

For those aiming to access funds swiftly without incurring charges associated with instant withdrawal, exploring alternative financial solutions might be advantageous. Digital wallets, peer-to-peer payment systems, and specialized financial services offer distinct features that could better align with individual financial requirements.

Digital wallets provide a secure and typically cost-free platform for transferring funds, while peer-to-peer systems like certain payment apps enable direct and often instantaneous money transfers between individuals. These alternatives often bypass traditional banking delays, offering a middle-ground solution to the dichotomy between speed and cost.

Conclusion

A comprehensive understanding of the differences between instant withdrawal and standard processing times is essential for effective financial management. Instant withdrawals offer unparalleled speed but at an added cost. Conversely, standard processing times present a more economical choice with slower delivery of funds. By evaluating personal financial needs and understanding the terms and conditions set by financial service providers, individuals can make informed decisions that align with their unique financial situations.

Moreover, for those seeking additional guidance, consulting the policies of one’s financial institution or seeking advice from a financial advisor can offer further insights and clarity on the matter. Exploring alternative financial solutions might also present viable options tailored to one’s specific financial objectives.